Moneyhub: Smart Budget Planner

Sviluppatore Moneyhub Financial Technology Ltd

Moneyhub will help bring your money to life and see all of your finances in one place, so you always know where you stand. Using our wide range of intelligent money management tools will help you achieve your financial goals.

UNDERSTAND YOUR MONEY:

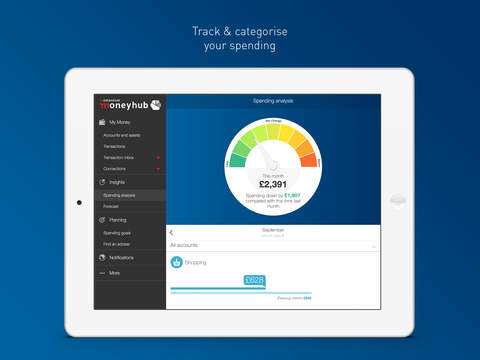

• Moneyhub intuitively categorises your transactions, and Spending analysis shows you exactly where your money goes each month.

• Set Spending budgets and track your progress, so you can free up extra cash for the things that matter.

• Regular payments let you review upcoming bills and any other regular payment activity detected each month.

• Access your personal dashboard, designed to help you make the most out of your money, and gain valuable insight into how you are doing and how to improve.

• Use Forecast to map out what your finances could look like in the future.

SECURE AT ALL TIMES:

• Secure payments enable you to transfer money between connected bank accounts and pay any UK bank account securely with the sort code and account number.

• Moneyhub has bank-level authentication and security and runs recurring penetration tests and security audits.

• We use a range of robust measures to keep your information safe at all times.

• We are authorised and regulated by the Financial Conduct Authority (FCA) and have gained ISO 27001 certification.

• Unlike some of our competitors, we won’t sell your data to third parties or try to sell you products that you don’t need.

WHAT THE EXPERTS SAY:

“There are plenty of apps that allow users to monitor their spending and manage their money, but Moneyhub has a few additional tricks and a remarkably clear design. Moneyhub has certified bank-level security, so users don’t have to worry about leaving themselves at risk.”

- Felicity Hannah, The Independent

“If you look at your bank account each month and wonder just where all your cash went, then this could be the app for you. It allows users to plan a budget and track where their money is spent, along with tools for taxes, pensions, and mortgages.”

- Abhijeet Ahluwalia, The Sunday Times

WHAT OUR CUSTOMERS SAY:

“I’ve tried out all the banking aggregators over the last 5 years and this is easily head and shoulders above the rest.”

- Lincoln

“Moneyhub quickly and simply pulled together my finances as a whole and detailed where I was overspending. Something not immediately obvious until demonstrated so informatively by the Moneyhub review. The perfect financial companion.”

- Bradley

Once your trial ends you can choose to continue your premium membership for just £1.49 per month or £14.99 per year. We charge for Moneyhub because you are the customer – not the product. Moneyhub is available across all major mobile and tablet devices, as well as desktops and laptops, meaning that wherever you choose to manage your money, Moneyhub is there for you.

• Payment will be charged to your iTunes Account at confirmation of purchase

• Subscription automatically renews unless auto-renew is turned off at least 24 hours before the end of the current period

• Account will be charged for renewal within 24 hours prior to the end of the current period, and identify the cost of the renewal

• Subscriptions may be managed by the user and auto-renewal may be turned off by going to the user’s Account Settings after purchase

• No cancellation of the current subscription is allowed during the active subscription period. This does not affect your statutory rights

• Any unused portion of a free trial period, if offered, will be forfeited when the user purchases a subscription to that publication, where applicable

www.moneyhub.com/privacy-policy-and-cookies

www.moneyhub.com/terms-of-use